Articles

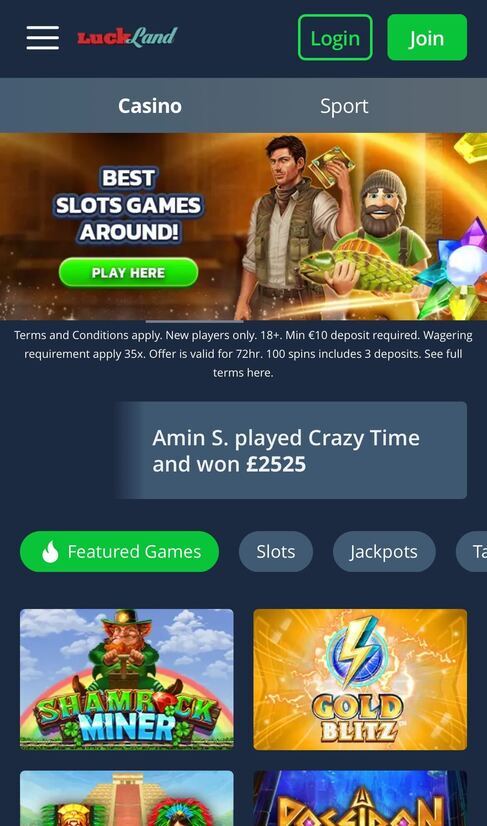

This type of spins are usually restricted to specific game, so browse the terms and conditions basic. Personal gambling enterprises render $step 1 deposit welcome packages for new players. Usually, you’ll get thousands if not an incredible number of gold coins to use as the virtual money on the website otherwise software. Browse the finest Bitcoin casinos on the internet to possess 2025 and you may sign up our very own best web site today. Learn more about Bitcoin gaming and how to start out with Bitcoins.

Locating the Equilibrium: Kidney Situation and Higher Phosphorus

The menu of $step 1 deposit casinos above is of the highest quality and that our really demanded. For this reason, participants can expect a honor-successful experience in several if not a large number of online game, fair campaigns featuring your’d merely expect to discover regarding the greatest brands in the world. The professionals features rated her or him while the best and include complete gambling establishment ratings to incorporate much more about what you could assume.

Most recent Marcus because of the Goldman Sachs Cd Cost

You’re merely trying to place your cash in the bank, that’s ideally welcome, regardless of the matter. “The financial institution not any longer should have POD in the account label or in their facts as long as the newest beneficiaries is actually listed someplace in the bank information,” Tumin told you. “When you are in this form of boots, you have got to focus on the bank, since you may not be capable intimate the brand new account or replace the membership up until they matures,” Tumin said. If you have $250,one hundred thousand otherwise shorter transferred inside a lender, the fresh alter will not affect your. You have chosen otherwise had been provided with an alternative PIN, a code you need to enter into the newest Automatic teller machine otherwise that you may be needed to get in to the POS terminal whenever you make use of Atm/Debit Card.

Learn Your Exposure Limits

Banking companies may to take into consideration what kind of look at is becoming transferred. Once again, according to the financial, you might not be allowed to deposit their $10,000 consider through mobile deposit on your cellular phone otherwise in the an enthusiastic Automatic teller machine. Your lender tend to casino Megawins review nonetheless declaration the put on the Internal revenue service while the usual; simply your own lender get use a short-term hang on your money. It’s called the Bank Secrecy Operate (aka. The newest $ten,one hundred thousand Code), although which could look like an enormous magic for you now, it’s vital that you find out about so it laws for many who’re also trying to generate a huge bank put more four figures. While the issue is sometimes justified, you’ll find instances where depositors is unknowingly go into difficulties in the event the they won’t manage higher dumps correctly.

The fresh FDIC brings together all the solitary accounts owned by a similar person in one bank and you will assures the total as much as $250,000. The new Spouse’s solitary account dumps don’t exceed $250,100 so his fund are totally insured. Whenever many of these criteria are came across, the fresh FDIC tend to insure per fellow member’s need for the plan to $250,000, on their own from people membership the new employer otherwise employee may have inside the the same FDIC-insured organization. The brand new FDIC usually means it exposure because the “pass-due to coverage,” because the insurance passes through the fresh company (agent) one to based the new account to your worker that is felt the newest proprietor of the financing. If a believe has one or more proprietor, per proprietor’s insurance is actually determined separately. In general, for each proprietor out of a believe Membership(s) is insured to $250,one hundred thousand for every novel (different) eligible beneficiary, up to a maximum of $1,250,100000 for 5 or more beneficiaries.

- The money will generally be around zero later on compared to the 7th business day following day’s your own put.

- For every holder is covered to $250,one hundred thousand per recipient as much as a total of $1,250,000 whenever five or higher beneficiaries are called.

- The fresh FDIC contributes together with her the deposits inside old age profile in the list above owned by a similar people in one covered bank and you will ensures the total amount to a maximum of $250,100000.

- When you’re signed up for the fresh Innovative Dollars Put system, Eligible Deposits that are swept to Program Banking companies are not securities, commonly bucks balances held because of the VBS, and they are not covered by SIPC.

- Such as, SoFi Lender brings around $step 3 million inside the shelter because of the automatically submitting deposits around the its system away from mate banking institutions.

Such, landlords from cellular house inside Arizona must pay 5% a year. Should your property manager is the owner of several devices, this may rating high priced plus the landlords must invest the currency smartly to help you pay you to definitely 5% rather than time-of-pouch (or want a significantly reduced deposit up front). In some cases, builders start by a standard offer, therefore a number of the terminology will be based on an everyday employment as opposed to the specifics of your own. You’re capable ask for a little down first fee or put. Sweeten provides people an exceptional renovation sense from the myself complimentary trusted general contractors to your investment, while offering pro information and help—free of charge to you personally. If the depositors beginning to question a financial’s protection, of several will get you will need to remove their cash from the bank, causing just what’s called a rush to your financial.

Can you imagine you have more $250,000 in one single membership?

You’re entirely guilty of keeping track of the brand new aggregate matter you has on the put at each and every System Financial in connection with FDIC restrictions, along with through other account from the VBS. Comprehend the Vanguard Financial Brush Issues Terms of use (PDF) and set of playing System Banking companies (PDF) for more information. For more information in the FDIC insurance rates, kindly visit fdic.gov. If it is time to best up the account, it certainly is a smart idea to enjoy in the our very own best-ranked online sites that give numerous financial procedures and you will currencies. The new step one$ lowest put casinos online render a convenient sense to own around the world professionals, which have easy deposits inside the regional money, making it very easy to keep track of. Pages will start to try out thebest games during the our greatest $1 lowest deposit casinos, having numerous safe put solutions inside 2025.